15 vs 30 Year Mortgage: Which is better for you?

Choosing the right mortgage is one of the most important things to do during your home buying journey. However, choosing the right mortgage can also be one of the more confusing things that you will do. This is why it is extremely important that you know both the benefits and drawbacks of 15 year and 30 year mortgages so that you can make an informed decision.

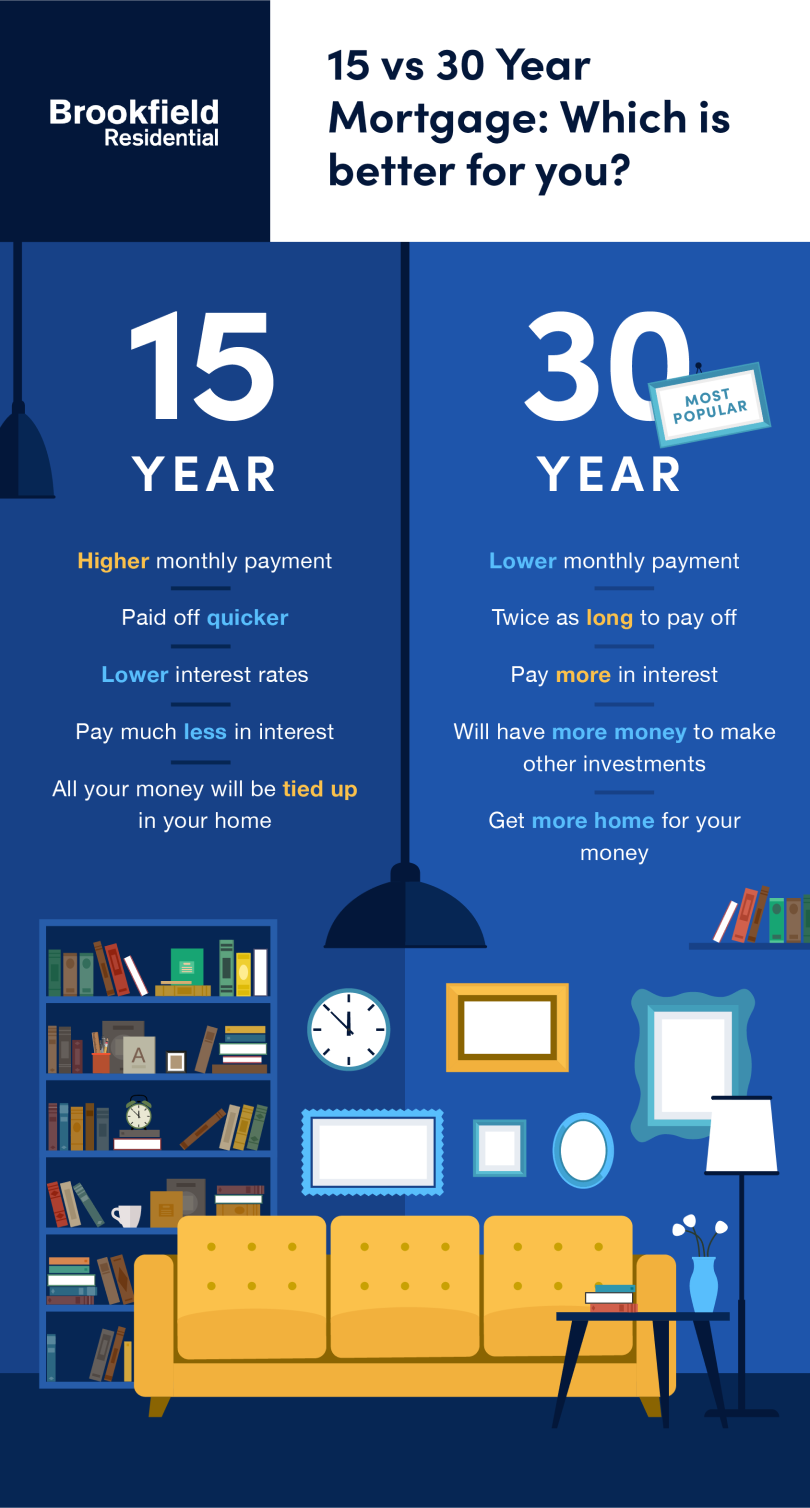

Below you’ll find an infographic that explains the main benefits and drawbacks of both types of mortgages to make it easy for you to choose the best mortgage for you. Those looking to pay off their home quickly with less interest will most likely favor a 15 year mortgage, while those looking to make other investments while paying off their mortgage will most likely choose a 30 year mortgage. Take a look at the infographic below to weigh the pros and cons of each type of mortgage.

For more information on mortgages or other help with your home buying journey check out our blog or contact us directly.

Infographic Text

15 Year Mortgage

- Higher monthly payment

- Paid off quicker

- Lower interest rates

- Pay much less in interest

- All your money will be tied up in your home

30 Year Mortgage

- Most popular choice

- Lower monthly payment

- Get more home for your money

- Will have more money to make other investments

- Twice as long to pay off

- Pay more in interest